Business and working professionals surely have encountered the W-2 and W-4 tax forms. These two vital documents from the Internal Revenue Service (IRS) ensure that taxes are reported correctly during tax season.

As the names of these closely resemble each other, they can still confuse some employees and employers. Understanding them and their users is vital. The comprehensive guide provides an in-depth look at the W-2 vs. W-4 differences and some of their distinctions. Read along.

What is the W-2 Form?

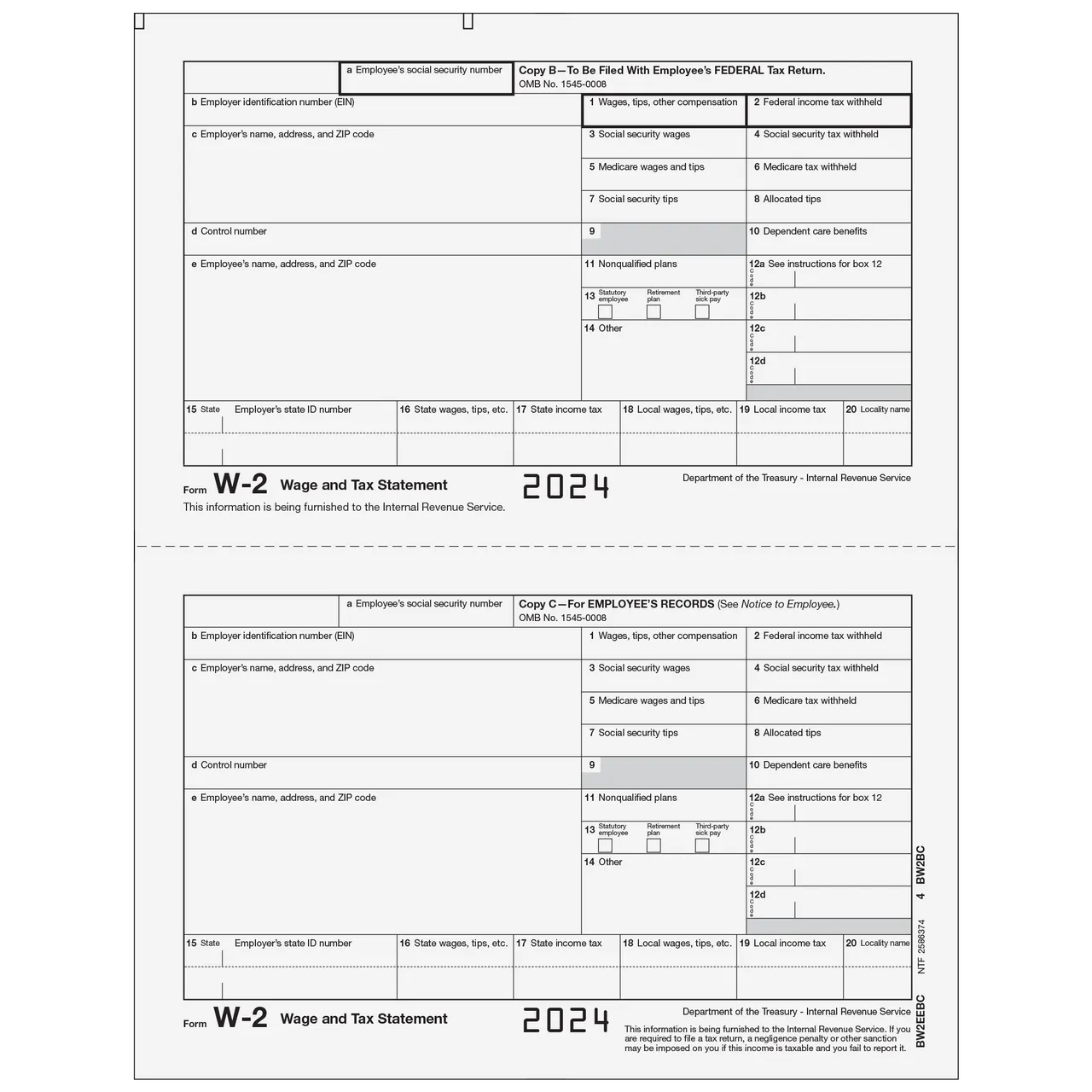

This form, also called the Wage and Tax Statement, summarizes the employee's total income, including the tax withholding for the previous year. Furthermore, the form shows deductions from the employee’s pay, such as Social Security taxes, Medicare, and dependent care. The W-2 form must be completed by January 31 of the following year. Copies will also be submitted to the state and local authorities and the Social Security Administration (SSA).

The data below shows the key points one must fill in using the W-2 form.

1. The Social Security number of the employee

2. Employer’s name, Employer Identification Number (EIN), address, and zip code

3. Tips

4. Wages

5. Withheld Social Security, Medicare, state, federal income, and local income taxes

6. Allocated tips

7. Nonqualified plans

8. Dependent care benefits

9. Employer-sponsored health insurance

10. Deferred compensation

What is the W-4 Form?

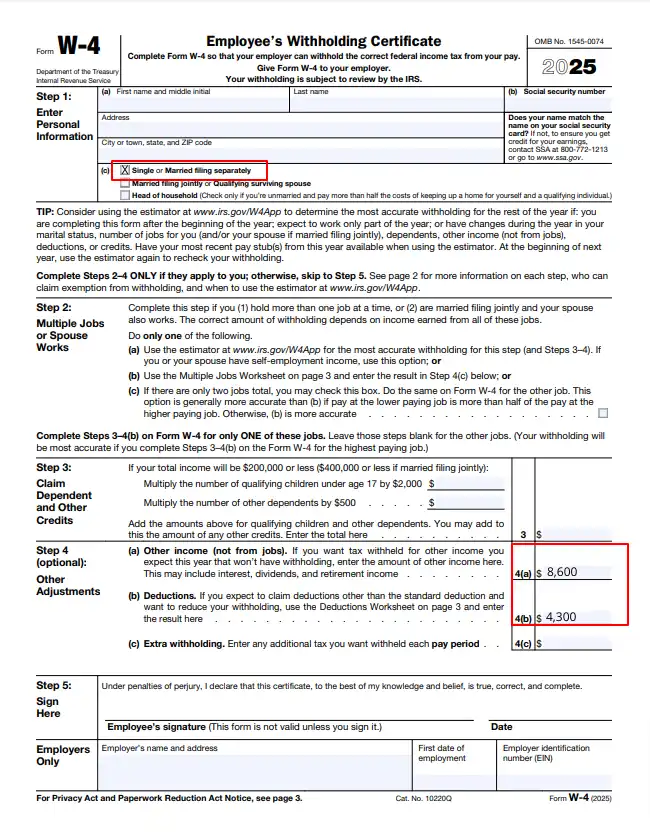

The W-4 represents the withholding allowance certificate of employees. It shows the employer and its payroll department how much tax must be withheld from an employee’s paycheck every time they run the payroll. In most cases, the employee is asked to fill out this form at the time of hiring so employers can adjust the payroll accordingly.

Among the essential details on this form are:

- The employee’s name, address, and marital status

- Claim dependents

- Employee’s signature

- Withholding adjustments

- Spouse works or multiple jobs

What's the difference between a W2 and W4?

Looking closely at the descriptions above, the two forms generally have a glaring difference. The following points dive deeper into the differences you should be aware of.

1. Information Needed

When filling out the W-2 form, there are most likely several boxes requiring employees to provide the correct details about their earnings. These include compensation, tips, and salary, to name a few. The form also needs proper information on taxes withheld.

On the other hand, the W-4 has relatively few boxes. It generally requires data about the employees' tax withholding preferences. The filing status, number of allowances, and other preferred withholdings should be included in the form. In short, tax deductions and earnings are not required on the W-4 form.

2. Purpose

The W-2 form aims to get an employee’s earnings and tax withholding data. Meanwhile, W-4 creates the employee’s withholding certificate so the employer can withhold the required tax. These two forms work together to ensure correct tax reporting and deduction. While W-2 reports past income, W-4 ensures accurate future withholdings based on the employee's current tax situation and preferences.

3. Who Fills It Out?

Employers will complete W-2 forms and send copies to each employee, the Social Security Administration, and state and local agencies. Meanwhile, employees fill out the W-4 during onboarding or before their first payroll. This division of responsibility helps streamline tax compliance. Employees update W-4 as needed, while employers handle W-2 submissions based on annual payroll data and official guidelines.

4. Submission Schedule

Among the W-2 vs. W-4, the differences are when these two forms are submitted. As mentioned, no later than January 31 of the following year is the submission of W-2 forms. A W-4 form does not need to be submitted externally. It must be appropriately filled out and given to employers before employees get their first salary. Accurate timing ensures compliance and prevents tax issues.

5. Frequency

Employers must complete and submit W-2 forms annually for each employee in the company. Meanwhile, employees only need to submit the W-4 once. They can fill out the same form when their personal or financial status changes. This flexibility allows employees to adjust withholdings after major life events like marriage, having children, or income changes, while employers maintain yearly reporting.

Common Mistakes Made With Your W-2 and W-4 Forms

Penalties when you make mistakes on these federal tax forms can be costly. With this, you must ensure to avoid them as much as possible.

1. Inaccurate classification of employees: An employee’s classification determines the IRS form to be completed. Company employees must fill out the W-2 form. You can refer to the IRS common law regulations to determine whether the employee will be classified as a company employee or an independent contractor.

2. Missed deadlines: If the W-2 form is submitted beyond the deadline without reasonable cause, the company can be subject to penalties. The fee is around $60 for every W-2 form. This can significantly affect companies with a large workforce.

3. Missing some of the personal data: Recording incorrect social security numbers or employees’ names on these tax forms merits penalties, as Section 6721 of the Internal Revenue Code states. Reviewing the spelling, personal data, and wage figures before submitting the forms is best.

4. Inaccurate wage determination: Determining an employee's wage is critical to correctly input the data required on Box 1 of the W-2 form. Errors in wage calculation can lead to incorrect tax reporting, penalties, and employee dissatisfaction. Employers must ensure all taxable income, including bonuses and fringe benefits, is accurately reported to avoid compliance issues with the IRS and maintain employee trust.

Filling Out W-2 and W-4 Forms

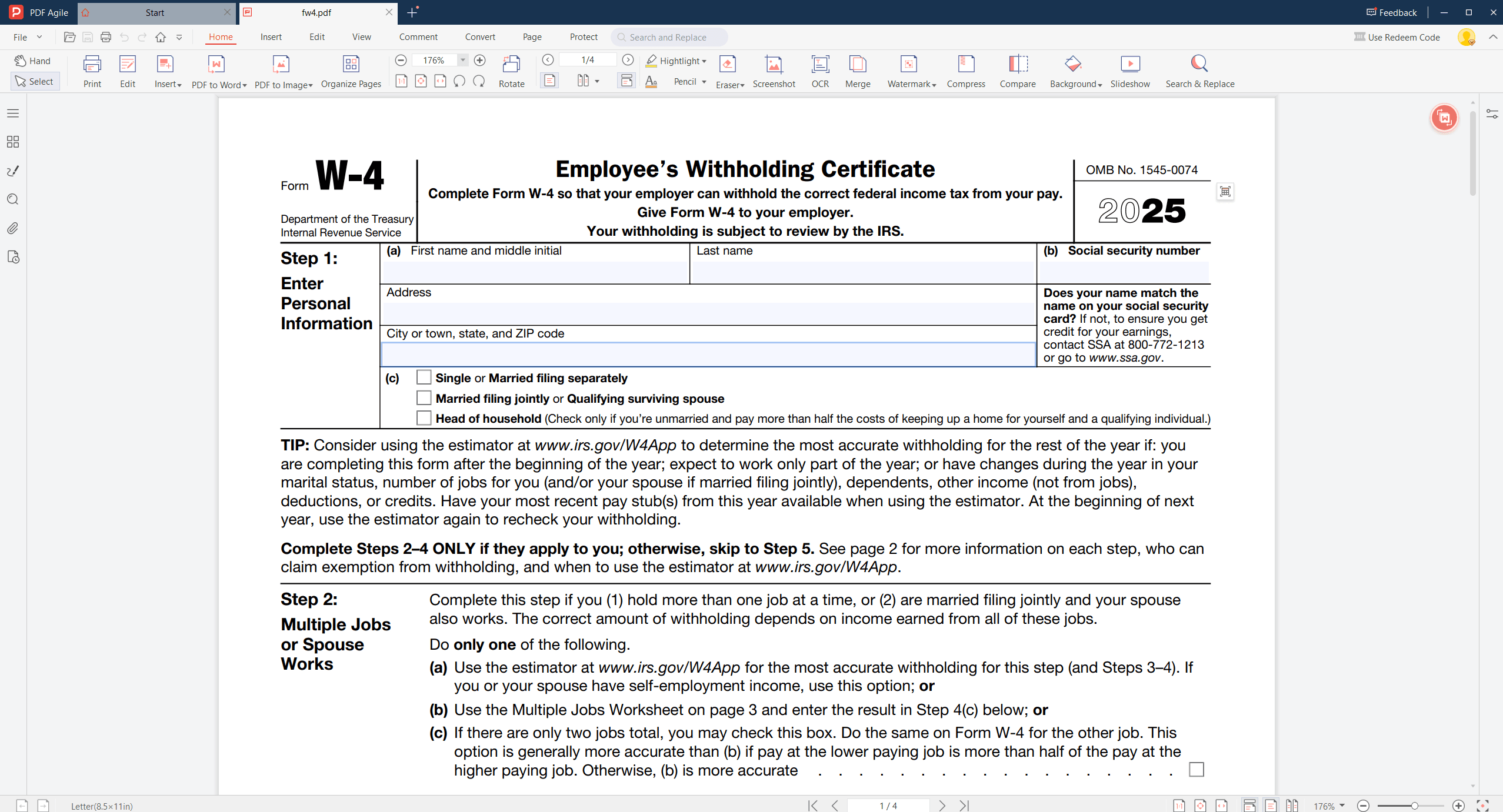

You can download the W-2 and W-4 forms through the IRS website. There are detailed instructions for filling out these forms. Essentially, you need to download these forms. A PDF editing tool will be helpful in terms of filling in the boxes.

PDF Agile is a straightforward and user-friendly PDF-filling software you can download for free. The extensive tools and features allow you to maximize your editing preferences. We’re providing an easy guide on using PDF Agile and completing your W-2 and W-4 forms.

1. Download the forms on the IRS website.

2. Install the PDF Agile app on your desktop and launch it.

3. Go to ‘File’ and click ‘Open.’ Import the form you want to edit.

4. Click ‘Edit’ from the menu section to fill in the boxes on the form. Use the ‘Add Text’ function.

5. Save the completely filled-out tax form.

W-2 and W-4 forms are important documents that companies must ensure that they fill out and submit on time to comply with the IRS regulations. Now that you know the difference between a W2 and a W4, it will be much easier to remember the proper tax form to fill out in specific situations.

For Further Reading

Today, technology has made company processes much easier, so ensure that PDF Agile is maximized. It’s designed to accommodate all levels of PDF users; even beginners can easily navigate the interface. At the same time, the software also has advanced features for PDF users who wish to make more customizations on their forms. With its cloud integration, collaboration tools, and secure editing options, PDF Agile becomes an indispensable tool for businesses aiming for efficiency and precision in document handling. Also, you can find more interesting knowledge articles in Knowledge | PDF Agile.