In the journey toward homeownership, many individuals face challenges that can make traditional purchasing methods seem out of reach. Rent to Own Agreements offer a unique and flexible pathway, bridging the gap between renting and owning a home. These agreements provide an innovative solution for those who may not be immediately ready to secure a mortgage, allowing them to build equity and work towards homeownership over time. By understanding the structure, benefits, and considerations of Rent to Own Agreements, prospective homeowners can make informed decisions and take confident steps toward achieving their dream of owning a home. This article explores the essentials of Rent to Own Agreements and how they can serve as a practical route to homeownership.

What is a Rent-to-Own Agreement?

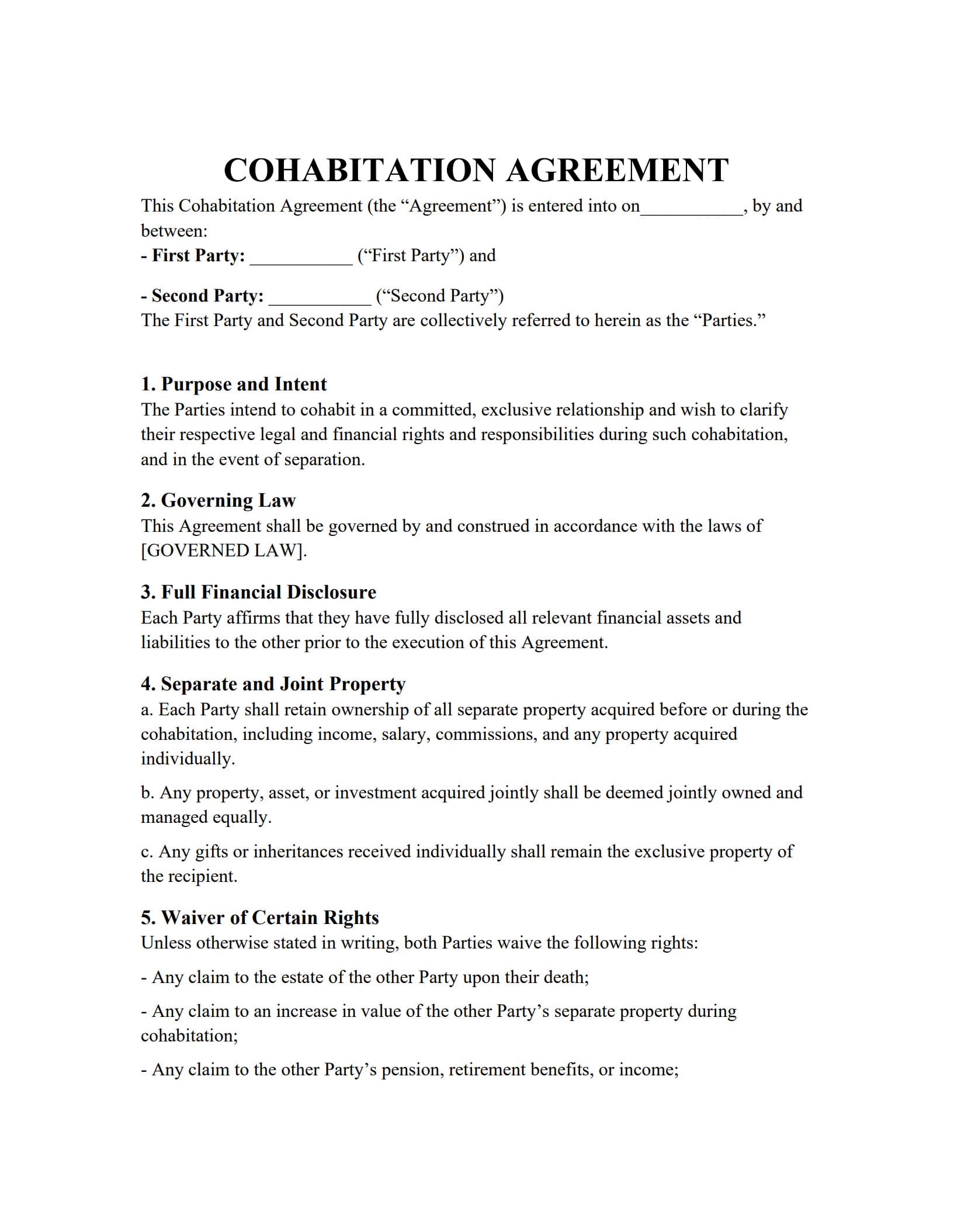

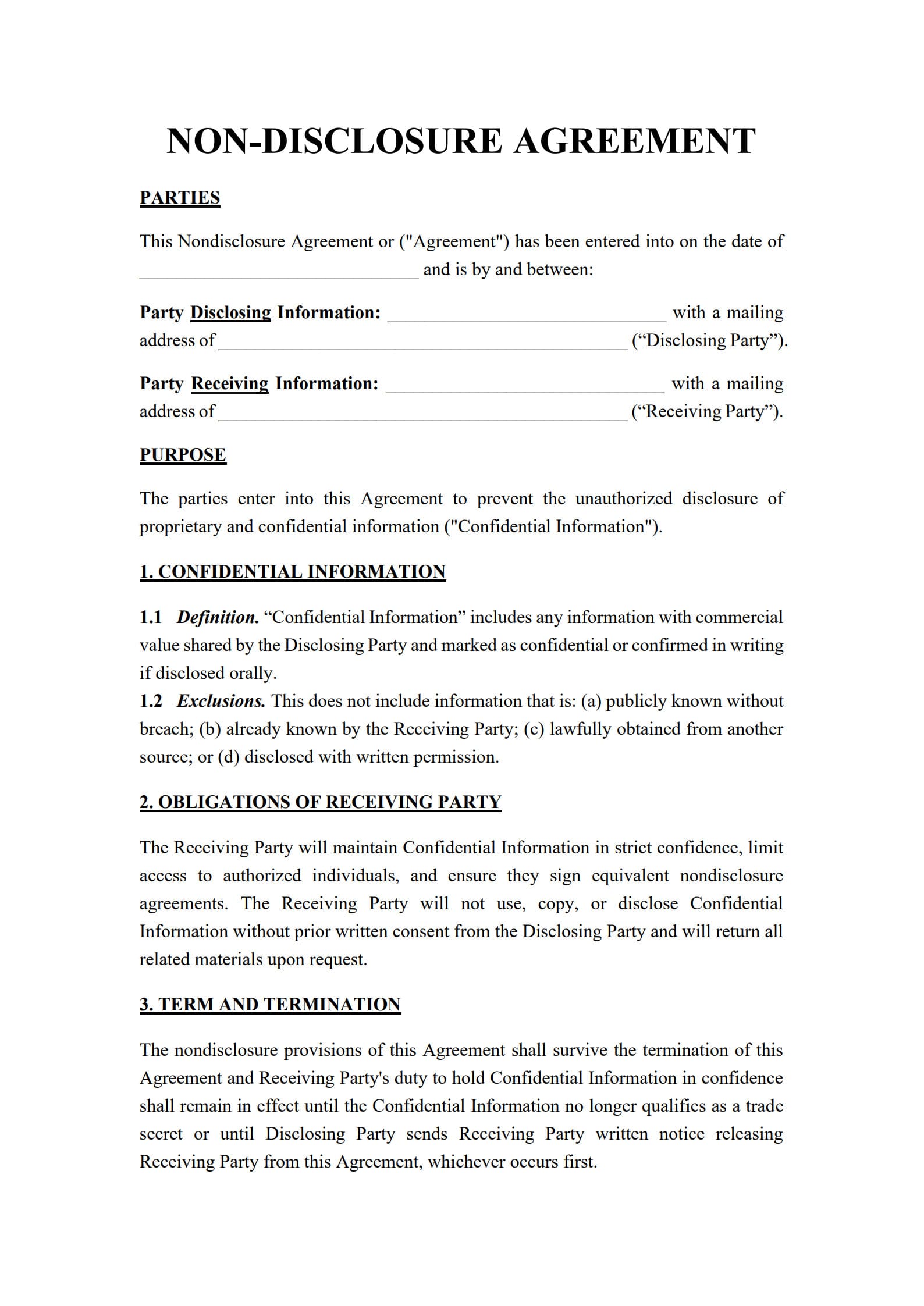

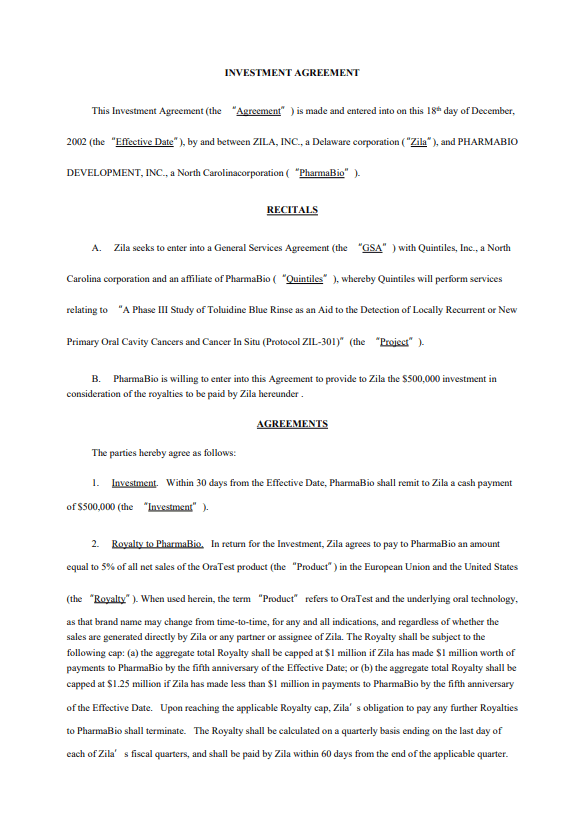

A Rent to Own Agreement, also known as a lease-to-own or lease-option agreement, is a contractual arrangement that combines elements of a traditional rental agreement with an option to purchase the property at a later date. This type of agreement is designed to provide tenants with a pathway to homeownership, particularly for those who may not be immediately ready to secure a mortgage due to financial constraints or credit challenges.

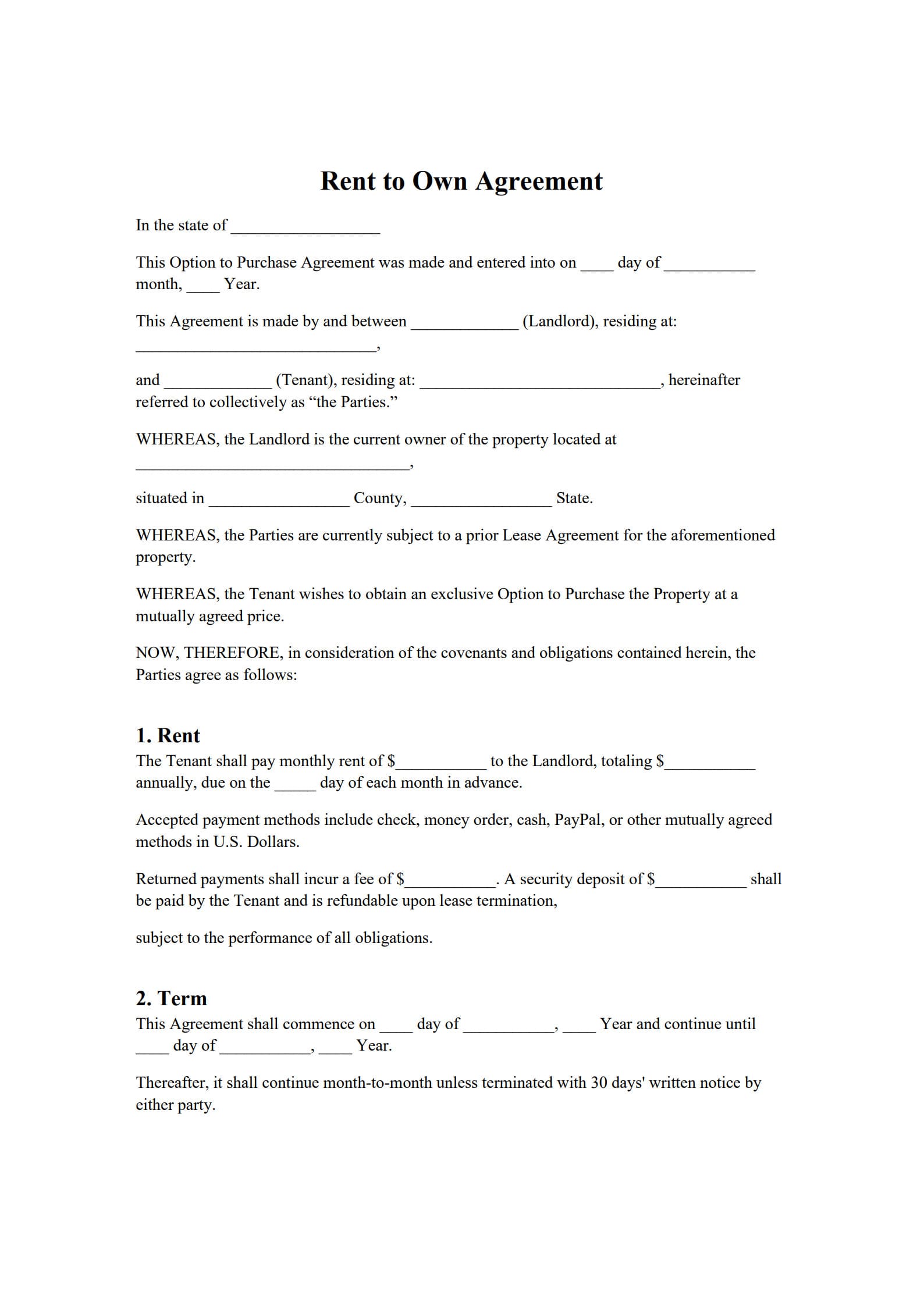

In a Rent to Own Agreement, the tenant (or tenant-buyer) agrees to rent the property for a specified period, with a portion of the rent payments often credited toward the eventual purchase of the home. The agreement typically includes an option fee, which is an upfront payment that grants the tenant the exclusive right to buy the property at a predetermined price within a certain timeframe.

Key features of a Rent-to-Own Agreement include:

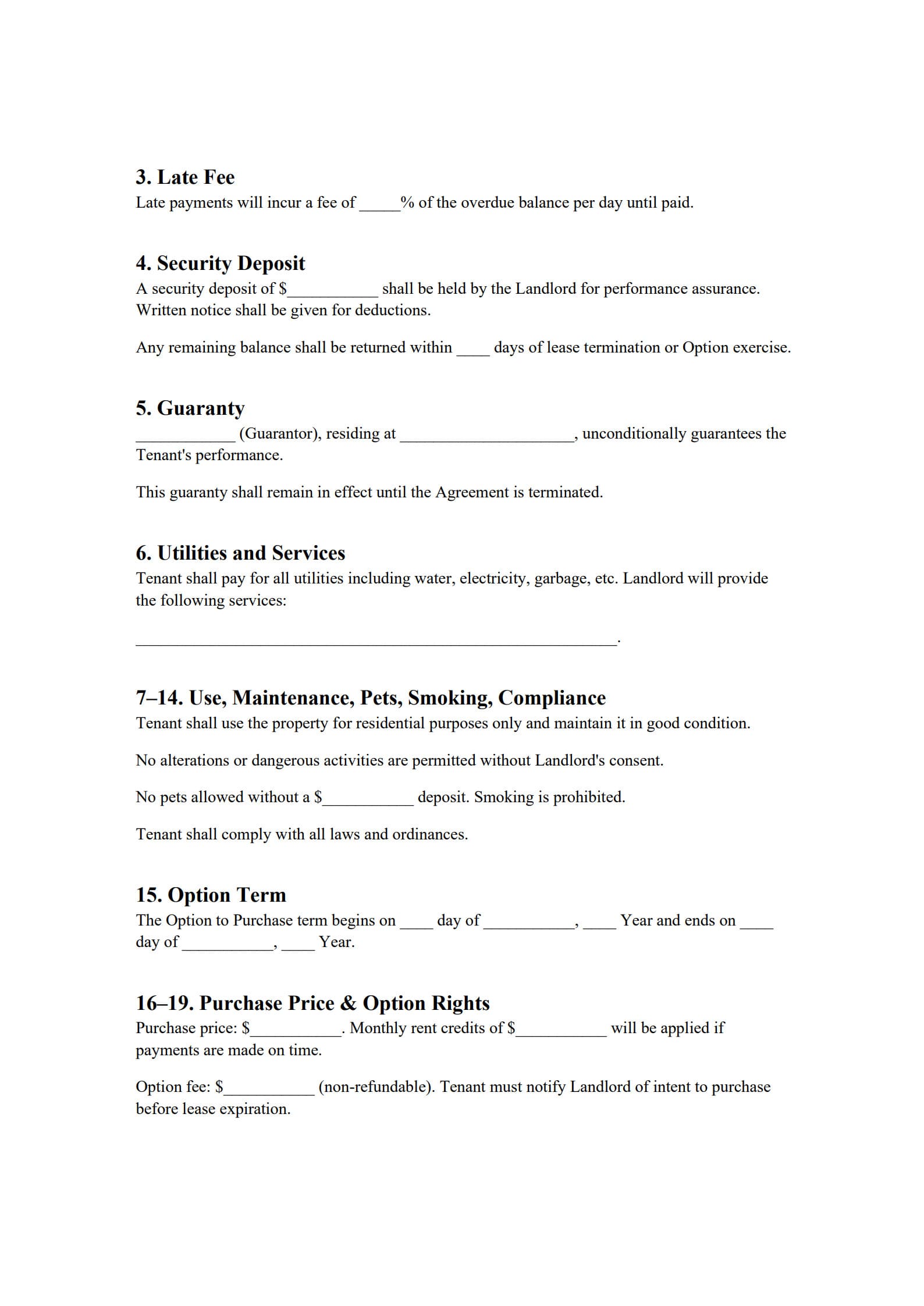

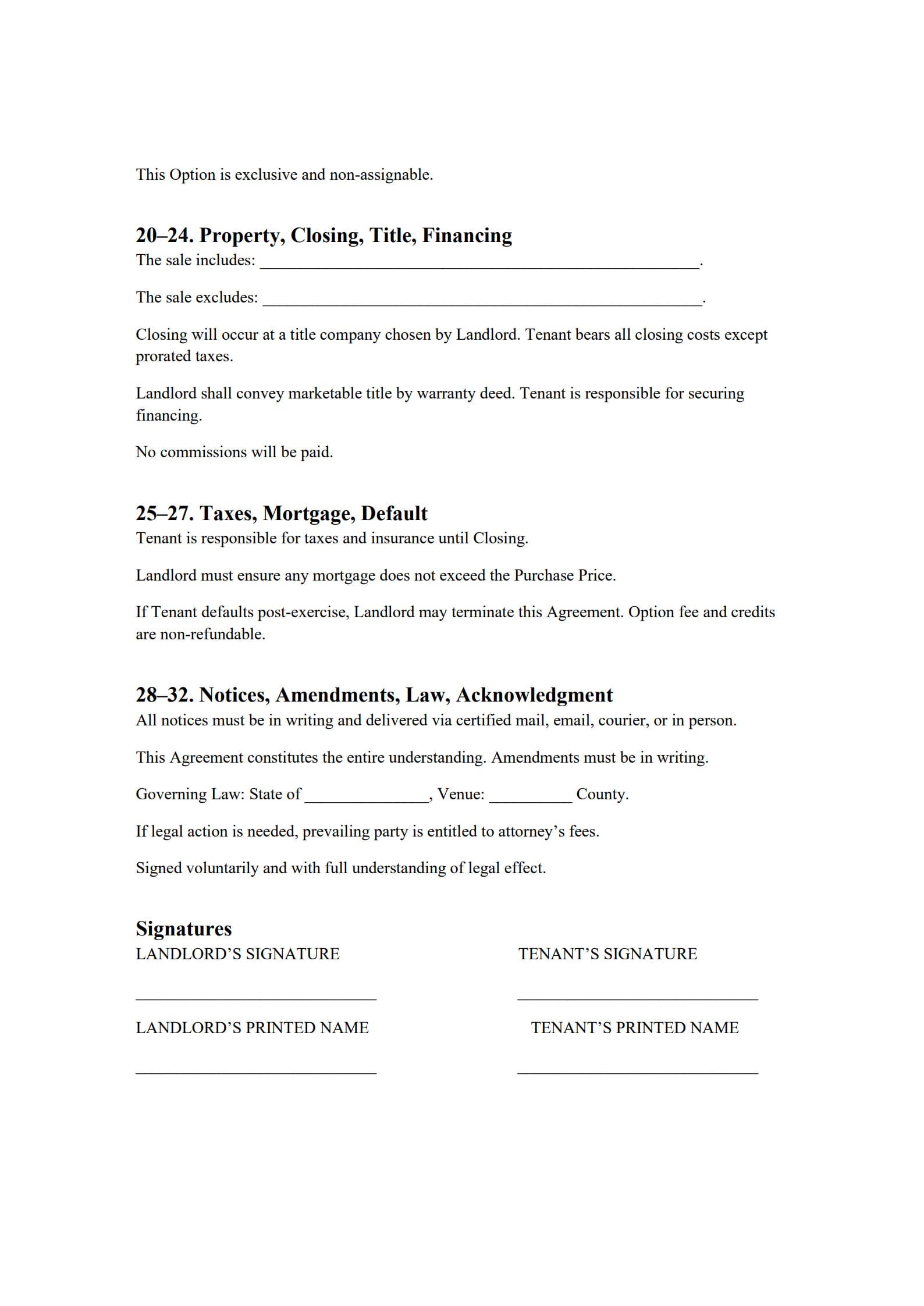

Lease Term: The duration of the rental period, during which the tenant pays rent and has the option to purchase the property.

Purchase Price: The agreed-upon price at which the tenant can buy the property, often determined at the beginning of the agreement to protect against market fluctuations.

Rent Credits: A portion of the monthly rent payments that may be applied toward the purchase price, helping the tenant build equity over time.

Option Fee: An upfront fee paid by the tenant to secure the option to purchase the property, which is typically non-refundable but may be credited toward the purchase price.

Maintenance and Responsibilities: Clarification of who is responsible for maintenance and repairs during the rental period, which can vary depending on the agreement.

Benefits of a Rent-to-Own Agreement

Rent to Own Agreements offer a range of advantages for individuals aspiring to become homeowners but who may face barriers with traditional purchasing methods. Here are some key benefits:

1. Pathway to Homeownership for Those with Credit Challenges: Rent to Own Agreements provide an opportunity for individuals with less-than-perfect credit scores to work towards homeownership. The extended lease period allows time to improve creditworthiness and financial stability.

2. Locking in a Purchase Price: The purchase price is typically agreed upon at the beginning of the agreement, protecting the tenant-buyer from future market fluctuations and potential increases in property value.

3. Building Equity Through Rent Credits: A portion of the monthly rent payments may be credited toward the purchase price, allowing tenant-buyers to build equity in the home over time, even before they officially own it.

4. Time to Improve Financial Standing: The lease period offers tenant-buyers time to save for a down payment, improve their credit scores, and address any financial issues that may have previously hindered their ability to secure a mortgage.

5. Opportunity to Test the Property: Living in the home before committing to purchase allows tenant-buyers to ensure the property meets their needs and expectations, reducing the risk of buyer's remorse.

6. Flexibility and Accessibility: Rent to Own Agreements can be more accessible than traditional home buying, offering a flexible route to ownership for those who may not qualify for a mortgage immediately.

7. Potential for Lower Upfront Costs: Compared to traditional home buying, Rent to Own Agreements may require lower upfront costs, making it an attractive option for those with limited savings.

8. Stability and Security: Tenant-buyers can enjoy the stability of living in a home they plan to purchase, fostering a sense of security and community involvement.

How to Use Our Rent-to-Own Agreement Template?

Method 1: Digital Distribution

Download the Template

- Click the download button to get your free Rent to Own Agreement Template.

Edit with Ease

- Use a PDF editing software like PDF Agile to personalize the template.

- Obtain the correct form, specify your agent and their powers, sign it with the required legal formalities, and store it securely.

Send a Digital Receipt

- Save your creation and email it directly to relevant parties for a seamless and paperless experience.

Method 2: Printed Professionalism

Download the Template

- Click the download button to get your free Rent-to-Own Agreement Template.

Print it Up

- Choose high-quality paper and print your receipts.

- Fill in the details by hand if needed.

Hand-Deliver or File

- Hand-deliver or file your printed receipts to ensure proper documentation and record-keeping.

Free Download: Printable Rent to Own Agreement Template

To help you get started, we have created a free, printable Rent to Own Agreement Template. You can download the template by clicking the Use Template button on this page.

You can also explore more Agreement PDF templates in PDF Agile Templates Center.